Like the rest of the country, metropolitan Washington is expected to feel lasting economic impacts from COVID-19. COG has been tracking some recent positive and negative trends as part of our monthly Regional Economic Monitoring System (REMS) report, an analysis we’ve published for more than 20 years.

As was the case with the Great Recession, the federal presence in the region has again helped to insulate us from the most severe impacts of the shutdown. While the federal government’s share of the area’s workforce has been shrinking, its workers still comprise nearly 12 percent of the region’s total jobs, and federal, state and local government sector jobs account together for nearly a quarter of the region’s total. When federal spending in the region is included, experts have estimated that the federal presence comprises more than 30 percent of our local economy.

In addition, as our region has diversified its economy in recent years, our Professional and Business Services sector has emerged as another key strength, comprising nearly a quarter of the region’s jobs. Many of these “office” workers have the flexibility to telework or work from home during the pandemic crisis, a trend that will likely continue throughout the summer and into the fall.

However, small businesses and thousands of workers employed in certain sectors such as Leisure and Hospitality, Retail Trade, and Education have been significantly impacted and continue to face an evolving and uncertain future. These workers are among our lowest wage-earners, and a potential resurgence in COVID cases could continue to affect these and other employment sectors.

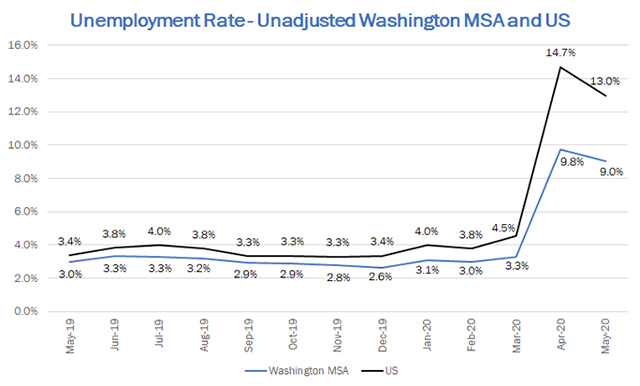

Unemployment Rate

Preliminary May data for the June 2020 REMS report shows the continued impact of unemployment due to COVID-19, with a slight national decline from the April rate of 14.7 percent to 13.0 percent for the month of May. Our region saw a minor decline in the unemployment rate, from 9.9 percent in April to 9.0 percent in May.

While several local employment sectors have been significantly impacted, when compared to other regions, metropolitan Washington’s current unemployment rate is comparatively low. For example, the Maui Island region in Hawaii had the highest unemployment rate during May at 33.4 percent, followed by the Atlantic City area at 32.4 percent. Both economies are highly dependent on tourism, hospitality, and entertainment. Closer to our region, metropolitan Baltimore and metropolitan Richmond experienced marginally lower unemployment rates with, respectively, rates of 9.5 percent and 9.7 percent.

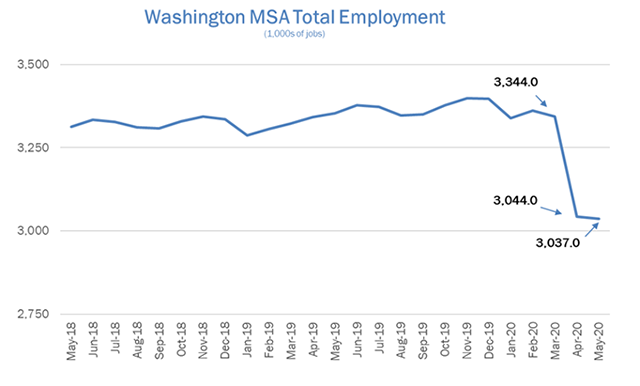

Job Sector Loss

Job sector data for the region indicates a near-term job loss of about 6,800 jobs (-0.2 percent) between April and May, but the region lost more than 324,300 jobs (-10.7 percent) between February 2020 and May 2020. Job losses during March and April were a more focused and immediate shock to the local labor market than during prior recessions when job losses were spread over many months. As a point of comparison, during the Great Recession, the region lost 58,000 jobs between December 2007 and June 2009. The job loss during the Great Recession was a more gradual decline over many months compared to the current economic downturn that occurred over several weeks.

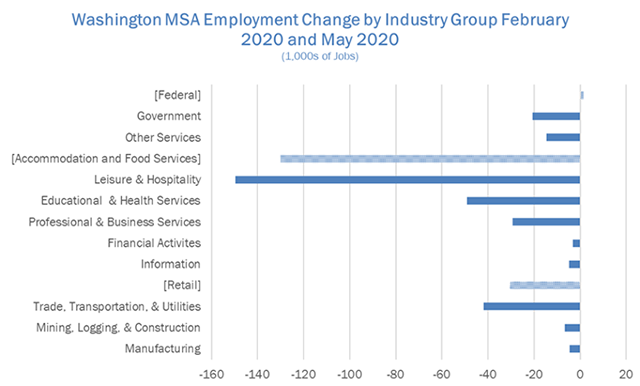

As illustrated in the chart below, most of the job losses occurred in the Leisure and Hospitality sector (-149,600) and the Trade, Transportation, & Utilities sectors (-42,000 jobs).

Nationally, the economy added approximately 2.9 million jobs (2.3 percent) back between April and May, however, the nation lost more than 17.7 million jobs (-13.3 percent) between February 2020 and May 2020.

The New York City metropolitan area had over-the-year decreases of more than 1.8 million jobs (-18.1 percent) and the Los Angeles area lost more than 859,000 jobs (-13.8 percent). The country shows similar job loss in the same sectors as our region, Leisure and Hospitality (-6.3 million jobs) and Trade, Transportation, & Utilities (-2.7million jobs). Closer to our region, metropolitan Baltimore lost 170,600 jobs (-11.9 percent) and metropolitan Richmond lost 60,300 jobs (-8.8 percent).

Leisure and Hospitality jobs are largely dependent on travel and tourism to the region, which has long been seen as a destination for business and personal travel, neither of which are showing strong recovery. Retail employment is more dependent on local consumer spending which appears to be increasing as we continue to ‘reopen.’

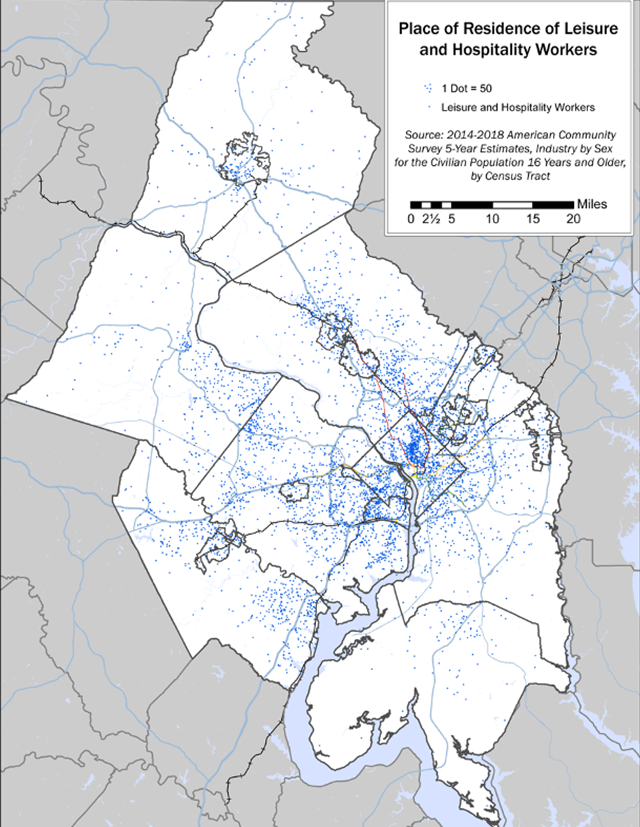

Locations of Vulnerable Workers

Data from the Census Bureau’s most recent American Community Survey (2018 ACS) shows that Leisure and Hospitality workers—who have experienced recent job losses at nearly four times the rate of any other major industry—reside throughout the COG region.

The map below shows that many Leisure and Hospitality workers live east of Rock Creek Park in the District of Columbia, in western Alexandria, South Arlington, Herndon and Annandale in Fairfax County, along US 1 in Fairfax and Prince William Counties, and in Wheaton and Twinbrook in Montgomery County. This reveals that COVID-related impacts on these vulnerable workers, ranging from housing instability to food insecurity, is a concern for the entire region.

Unemployment Insurance (UI) Claims

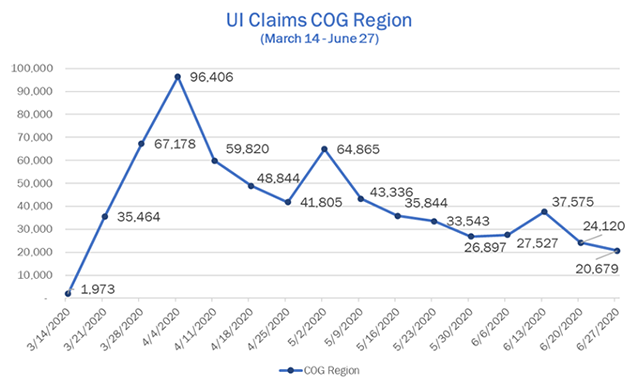

Unemployment Insurance (UI) claims across the COG region spiked in early April, accelerating from around 2,000 weekly claims in early March to more than 96,000 claims by the first week of April. Aside from claim spikes in early May and mid-June, regionwide UI claims have consistently declined within the last week of June, seeing approximately 21,000 claims. Cumulatively, since March 14, there have been nearly 666,000 unemployment insurance filings, with the lowest number of claims filed in the month of June. Claims data represent available aggregate UI claims reporting from DC Department of Employment Services, the Virginia Employment Commission, and the Maryland Department of Labor, Licensing, and Revenue.

The decline in the weekly number of workers filing for unemployment benefits suggests again that we may have seen the worst of the job losses.

What do all of these data suggest?

The region appears to have endured the most severe ‘shocks’ during the early weeks of the COVID-19 crisis. While our economy fared better than many other regions, small business owners and workers employed in Leisure and Hospitality, and some Retail jobs still face uncertain futures. While job losses and unemployment filings are slowing, it is unclear when we will begin to see robust growth. Also, the indirect impacts on the region’s housing markets are still evolving. COG will continue to monitor these trends through our monthly Regional Economic Monitoring System (REMS) report.

Department of Community Planning and Services Research Team

The Regional Economic Monitoring System (REMS) report, which COG has issued monthly since the mid-1990s, is a key report to follow to understand the extent of the impact the pandemic is having on key economic indicators. Visit the subscriptions page to sign up for REMS and other COG emails.